The UK mortgage market is likely to face continued headwinds in 2024, with forecasts pointing to reduced lending across several sectors. UK Finance notes that higher interest rates, persistent inflation, and stretched affordability continue to shape conditions for both homebuyers and existing homeowners.

While 2025 could bring early signs of improvement, 2024 is expected to remain a year of contraction. Higher borrowing costs could add further strain, leading to fewer mortgage approvals, slower property sales, and fewer refinancing opportunities. At the same time, ongoing economic uncertainty and tighter lending criteria may limit the range of mortgages available. First-time buyers may find it particularly difficult to secure borrowing as affordability checks remain stringent. With rate movements still a concern, more borrowers may lean towards fixed-rate deals for greater payment certainty.

Even so, lenders may look to maintain demand by refining their offerings. Longer mortgage terms and more flexible repayment features could help some borrowers manage affordability pressures. However, broader competition among lenders may remain muted due to economic conditions and regulatory pressures.

Property investors may also be affected by rising costs and weaker rental yields. Buy-to-let activity could fall further, especially as landlords respond to regulatory change and tax pressures. That said, some investors may adjust their approach and explore different strategies to preserve returns in an unsettled market.

Remortgaging is also likely to remain a key theme, particularly for homeowners reaching the end of fixed-rate deals. Many may see repayments rise when moving onto new terms, increasing the need for careful product selection. In this environment, mortgage brokers may play an important role in helping borrowers identify suitable options.

Overall, 2024 is expected to remain challenging for the UK mortgage sector. Affordability constraints, higher costs, and regulatory pressures are likely to influence lending patterns, although both borrowers and lenders may respond through more flexible products and evolving solutions.

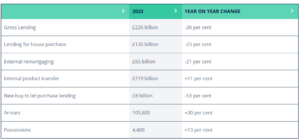

UK Mortgage Market Trends in 2023

The UK mortgage market experienced notable change throughout 2023 due to rising interest rates and increased household living costs. These pressures reduced overall mortgage affordability for many borrowers.

As a result, external remortgaging activity slowed significantly. Many borrowers chose to remain with their existing lender rather than move to a new provider. Internal product transfers became more common because they often allowed borrowers to switch rates without undergoing full affordability assessments.

During the same period, mortgage arrears increased slightly. Despite this rise, arrears remained low by historical standards. Approximately 1% of all outstanding UK mortgages were in arrears, indicating continued market resilience.

In response to economic uncertainty, borrowers actively sought flexible mortgage solutions to manage monthly repayments. Options such as specialist mortgage advice, payment flexibility, and tailored lending criteria became increasingly important.

Lenders adapted by expanding access to specialist lending solutions. These included support for borrowers with complex income or credit challenges, or those with refinancing needs. Products such as buy-to-let mortgages, second-charge mortgages, and short-term bridging finance played a key role in maintaining borrowers’ access to funding.

Overall, the UK mortgage market remained stable in 2023. While affordability pressures persisted, both lenders and borrowers adjusted by offering flexible products, making responsible lending decisions, and providing informed mortgage advice.

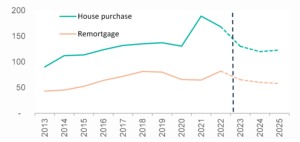

Source: UK Finance forecasts

2024 Mortgage Market Forecast: Declining Lending and Rising Arrears

Mortgage market forecasts for 2024 indicate a continued slowdown in overall lending activity across the UK. Gross mortgage lending is expected to fall by around 5 per cent, bringing total lending volumes to approximately £215 billion.

House purchase lending is projected to decline by 8 per cent, reducing total lending to around £120 billion. External remortgaging is also expected to fall by 8 per cent, reaching approximately £60 billion. Internal product transfers are forecast to follow the same trend, decreasing by 8 per cent to around £202 billion.

These changes reflect tighter lending conditions and ongoing affordability pressures. Borrowers are increasingly exploring specialist lending options as mainstream criteria tighten.

Buy to Let Lending Outlook

The buy-to-let mortgage market is expected to experience sharper declines than owner-occupied lending. Forecasts suggest a 13 per cent reduction in buy-to-let lending, lowering total volumes to approximately £7 billion.

Rising interest rates, tax changes, and affordability stress continue to impact landlord confidence. Many investors are seeking buy-to-let mortgage advice and alternative funding routes to manage portfolio pressures.

Rising Mortgage Arrears and Possessions

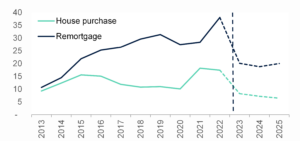

Mortgage arrears are forecast to increase throughout 2024. Cases are expected to reach approximately 128,800 by year’s end. This rise reflects ongoing cost-of-living pressures and higher mortgage repayments for many households.

Mortgage possessions are also predicted to increase by around 16 per cent, reaching an estimated 5,100 cases. While this represents an upward trend, possession levels remain below pre-pandemic levels.

Understanding arrears trends is essential for borrowers considering remortgaging options, product transfers, or specialist mortgage support.

What This Means for Borrowers and Lenders

The 2024 outlook highlights the importance of early planning and professional advice. Borrowers facing affordability challenges may benefit from reviewing their mortgage position before difficulties arise.

Lenders and advisers must continue to focus on responsible lending and tailored solutions. Monitoring economic indicators, interest rate movements, and lending criteria will remain critical.

For borrowers with complex circumstances, specialist mortgage advice can help identify suitable options and reduce long-term risk. Early engagement often provides more flexibility and better outcomes.

Economic Outlook and Mortgage Market Stabilisation

The UK mortgage market continues to face affordability pressures throughout 2024. However, signs of stabilisation are expected to become clearer by 2025. Rising wages, steadier interest rates, and easing inflation may gradually improve borrowing capacity. This shift is likely to support measured growth across specialist lending and mainstream mortgage activity.

Economic conditions directly affect mortgage affordability. More stable interest rates can help first-time buyers plan repayments with greater certainty. At the same time, consistent wage growth may allow more applicants to meet lender affordability criteria. This combination can increase confidence when considering property purchases.

Lower inflation may also reduce pressure on household budgets. As essential costs ease, borrowers may find it easier to manage monthly mortgage payments. This environment can improve mortgage approval rates and encourage lenders to introduce more competitive mortgage products. Buyers exploring buy-to-let mortgages or residential options may benefit from broader lender choice.

Economic stability often strengthens consumer confidence. Clear and consistent policy direction supports sustainable growth in mortgage lending. While affordability challenges may persist in the short term, improving conditions could help more borrowers access suitable mortgage solutions that align with their long-term financial plans.

Borrowers should continue to monitor market developments carefully. Speaking with mortgage advisers can help clarify eligibility, affordability, and product availability. Professional advice is particularly valuable for complex cases involving specialist lending, adverse credit, or non-standard income structures.

Property prices may experience modest adjustments as the market stabilises. Prospective buyers should assess affordability in detail before proceeding. Reviewing fixed- and variable-rate options can help identify mortgage products that align with individual goals and risk tolerance. Comparing repayment terms remains essential for informed decision-making.

Looking ahead to 2025, the mortgage market outlook appears cautiously positive. Improved economic conditions may enhance borrowing potential and support wider access to homeownership. While challenges remain, early preparation and informed mortgage advice can help borrowers respond effectively to changing market conditions.

Source: UK Finance forecasts

Buy-to-Let Sector Facing Multiple Challenges

The buy-to-let market faced notable pressure during 2023. New buy-to-let mortgage lending for purchases fell by 53 per cent, while remortgaging activity declined by 47 per cent. These reductions reflect the growing strain on landlords, notably smaller portfolio investors.

Rising regulatory requirements and increased tax liabilities have added further pressure. Many landlords now experience reduced net returns due to higher operating costs. At the same time, stricter affordability assessments have made it harder to secure buy-to-let mortgage approval. This has limited borrowing capacity and reduced overall investment activity.

Although forecasts indicate a slower decline in 2024, the challenges facing the buy-to-let sector remain significant. Ongoing regulatory changes continue to influence borrowing costs and long-term profitability. In response, some landlords are reviewing alternative ownership models, including limited company buy-to-let mortgages, to improve tax efficiency.

Lender criteria have also become more restrictive. This has reduced the number of available buy-to-let mortgage products and increased competition among borrowers. As a result, landlords must take a more strategic approach when reviewing finance options and assessing portfolio sustainability.

Interest rate volatility remains another key concern. Higher mortgage repayments have narrowed rental margins, prompting many landlords to consider fixed-rate buy-to-let mortgages for greater payment stability. Others are exploring buy-to-let remortgaging to release equity, manage debt more effectively, or improve cash flow.

Looking ahead, buy-to-let investors must stay informed about regulatory developments and market trends. Seeking specialist mortgage advice can help landlords understand lender criteria and identify suitable solutions. Regular portfolio reviews also allow investors to identify refinancing opportunities and manage costs more efficiently.

While uncertainty continues across the buy-to-let market, proactive planning remains essential. By remaining flexible and informed, landlords can protect their investments and position themselves to respond to future changes in the buy-to-let sector.

Source: UK Finance forecasts

Mortgage Arrears Remain Below Historical Levels

Mortgage arrears rose during 2023, increasing by around 30 per cent to approximately 105,600 cases. Forecasts indicate arrears could reach around 128,800 cases by the end of 2024. Despite this increase, levels remain below long-term historical averages, with expectations that growth may stabilise during 2025.

Several factors continue to limit a sharper rise in mortgage arrears. Robust affordability assessments play a key role in ensuring borrowers can withstand changes in interest rates or household costs. These checks remain central to responsible lending across the UK mortgage market.

Employment levels have also helped reduce financial stress. The UK labour market remains relatively strong, which supports borrowers in maintaining regular mortgage payments. Stable income remains one of the most effective safeguards against long-term arrears.

Lenders continue to provide structured support for borrowers experiencing temporary financial difficulty. Options such as payment holidays, interest-only arrangements, and loan term extensions are widely available. These solutions allow borrowers to manage repayments while avoiding default.

Borrowers who experience payment challenges should seek specialist mortgage advice as early as possible. Early guidance can help identify suitable support options and prevent arrears from escalating further.

Mortgage Possessions Expected to Remain Low

Mortgage possessions across the UK are forecast to rise only slightly in 2024. Current projections suggest around 5,100 cases, which remains significantly below historic norms. This reflects strong lender engagement and continued economic resilience.

Most possession cases relate to long-standing arrears rather than recent payment issues. Borrowers facing short-term difficulties often have access to tailored lender solutions that help avoid possession. These may include revised repayment plans or mortgage restructuring.

Lenders continue to prioritise early intervention. Flexible repayment options and temporary adjustments remain widely used to support borrowers in financial stress. This approach demonstrates a continued focus on borrower protection and sustainable homeownership.

Sustained employment levels remain a critical factor in limiting possession rates. Lenders increasingly work with borrowers to reach manageable outcomes rather than escalate cases unnecessarily.

Borrowers experiencing repayment pressure should promptly contact their lender. Early discussions can lead to practical outcomes such as reduced payments or extended loan terms. These options support arrears management while maintaining ownership.

Guidance on mortgage arrears support can help borrowers understand their rights, responsibilities, and available solutions before the situation worsens.

Market Outlook and Emerging Opportunities

Although 2024 presents ongoing challenges, the longer-term outlook for the UK mortgage market is gradually improving. As economic stability strengthens, affordability pressures may ease for both homeowners and buyers.

Inflation has begun to slow, and interest rates are expected to stabilise. This could reduce borrowing costs over time, improving access to remortgaging options and refinancing opportunities for existing homeowners.

Lenders are increasingly adapting products to meet evolving borrower needs. More flexible criteria and tailored solutions are becoming available, particularly within specialist lending and complex income scenarios. Staying informed is essential when evaluating mortgage options.

Government-backed initiatives may continue to support first-time buyers. Options such as shared ownership can provide alternative routes into the housing market for those struggling with affordability.

Property investors should also closely monitor market conditions. Rental demand remains strong in many regions, which may support long-term investment strategies. Reviewing buy-to-let mortgages and regional growth trends can help investors make informed decisions.

For borrowers seeking guidance, use “Find Mortgage Advisers” to connect with experienced professionals. Intermediaries looking to expand their specialist lending offering can “Join Our Mortgage Network” and access expert support through the wider Connect Group.

Thank you for reading our “UK Mortgage Lending | Trends & Outlook for 2024” publication. Stay “Connect“-ed for more updates soon!