Remortgaging to consolidate debts provides homeowners with a practical way to use property equity as financial security. This method simplifies debt management by combining multiple outstanding balances into one affordable loan repayment. It can cover unsecured debts under a single mortgage plan, including personal loans and credit card balances.

Homeowners with existing mortgages, whether with the same lender or a different provider, can refinance for debt consolidation. This refinancing option boosts borrowing capacity while reducing monthly repayments, offering greater financial control. It also simplifies budgeting, as one payment replaces several obligations.

In addition, remortgaging can potentially lower interest rates compared to unsecured loans. Reduced rates make repayments more manageable, saving money over time. However, it is crucial to assess the long-term costs before committing to refinancing.

Lenders assess affordability based on income, expenses, and credit history before approving applications. A strong credit profile can improve eligibility, rates, and terms. Moreover, borrowers must consider fees, such as valuation costs and arrangement charges, which impact overall savings.

Homeowners should seek advice from mortgage brokers familiar with the UK market. Brokers offer tailored solutions, ensuring borrowers secure competitive rates suited to their needs. They also help streamline the process, reducing complexity and delays.

While remortgaging offers financial flexibility, extending repayment terms may increase total interest costs. Borrowers must weigh the benefits and risks to determine suitability for their circumstances. Professional guidance ensures informed decisions aligned with long-term goals.

Using property equity to consolidate debts offers a structured way to manage finances. This approach simplifies repayments, reduces interest rates, and improves cash flow when carefully planned. Always review terms and seek expert advice to maximise benefits without compromising future financial stability.

What Are the Pros and Cons?

Remortgaging to consolidate debts is a strategic financial move to regain control over your finances. It merges multiple outstanding debts into a single, manageable monthly payment. This approach helps align financial obligations with income, avoiding late payment fees and high interest rates.

Key advantages include lower interest rates since mortgage rates are typically lower than unsecured debts. Consolidating high-interest debts into your mortgage reduces the overall interest paid. A single monthly payment simplifies finances, reducing the risk of late payments and easing budgeting.

Mortgages often have longer repayment terms, further lowering monthly payments. This is helpful for those facing financial difficulties. There can also be potential tax benefits, as mortgage interest may be tax-deductible. Consolidating debts and making timely payments can improve your credit score, demonstrating financial responsibility.

Managing a single payment reduces stress and improves financial well-being. However, there are downsides to consider. Using your home as collateral means failing to make payments could risk foreclosure. Extending the repayment period might lower monthly payments but increase the total interest paid.

Refinancing costs, such as closing and appraisal fees, should be considered. Consolidating debts through remortgaging requires financial discipline to avoid accumulating new debts. It’s a savvy strategy when interest rates are favourable and property values are rising, but it should be approached carefully.

Embarking on the Remortgage Application Journey

The remortgage process starts with thorough research. It is advisable to seek guidance from a mortgage broker like Connect Brokers. A full remortgage restructures your entire mortgage arrangement, either with your current lender or a new one. This can involve transitioning to a different mortgage deal or obtaining additional funds by extending the mortgage term.

Remember, exiting a mortgage deal early might incur charges. You’ll need to demonstrate your ability to meet new repayment obligations. Your lender will also ask about your intentions regarding accessing the funds.

Criteria for Debt Consolidation Remortgages

The suitability of remortgaging for debt consolidation depends on individual circumstances and property values. Questions to consider include: Do you have sufficient equity in your property? If your property’s value hasn’t appreciated, borrowing more might be challenging and costly. Does your current mortgage deal allow for debt consolidation? Terms of your initial mortgage arrangement might restrict eligibility.

Are there additional costs involved? Fees like solicitors’ and stamp duty are typically associated with remortgaging. However, sticking with your current lender may avoid some charges. Evaluate the total repayment amount, including interest, to see if it aligns with your financial goals.

Is Debt Consolidation a Prudent Choice?

Debt consolidation’s appropriateness varies based on individual circumstances. The extent of your debt and the repayment period can differ. One risk is falling back into old spending habits once debts are cleared. Reducing borrowing costs through remortgaging is wise. For instance, consolidating a £20,000 debt at 7.5% interest over 20 years makes monthly payments more manageable.

Will All Lenders Support Debt Consolidation Remortgages?

All lenders perform fundamental and regulatory checks. Lenders may inquire about the purpose of raising capital but should allow equity release for debt consolidation if prerequisites are met. Debt consolidation through remortgaging offers lower monthly payments and a fixed interest rate over an extended period. This simplifies financial obligations and reduces stress. However, it’s essential to exercise caution and assess the long-term implications.

The Motivation Behind Remortgaging

Remortgaging offers various benefits, one of which is debt consolidation. Consolidating debts into a single payment makes monthly financial management easier. Remortgaging can also provide additional funds for home improvements or investments. Securing a more favourable interest rate can lower monthly payments.

Another reason is switching to a flexible mortgage product that aligns with your financial plans. The decision to remortgage should follow careful evaluation and consultation with a mortgage expert to explore available options.

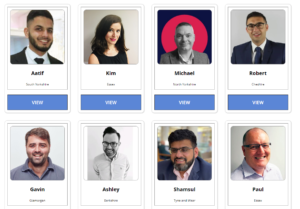

Why Connect Expert Brokers?

Connect Experty Brokers is a distinguished mortgage broker known for handling diverse remortgages. Our experienced advisors can guide you in securing the most appropriate deal. They offer valuable insights into each process stage, improving the likelihood of approval. Contacting Connect Brokers helps explore if remortgaging to consolidate debt aligns with your financial objectives. We provide the knowledge and support needed for an informed decision and successful remortgage journey.

Thank you for reading our publication “Remortgage to Consolidate Debts | Why Connect Expert Brokers.” Stay “Connect“-ed for more updates soon!