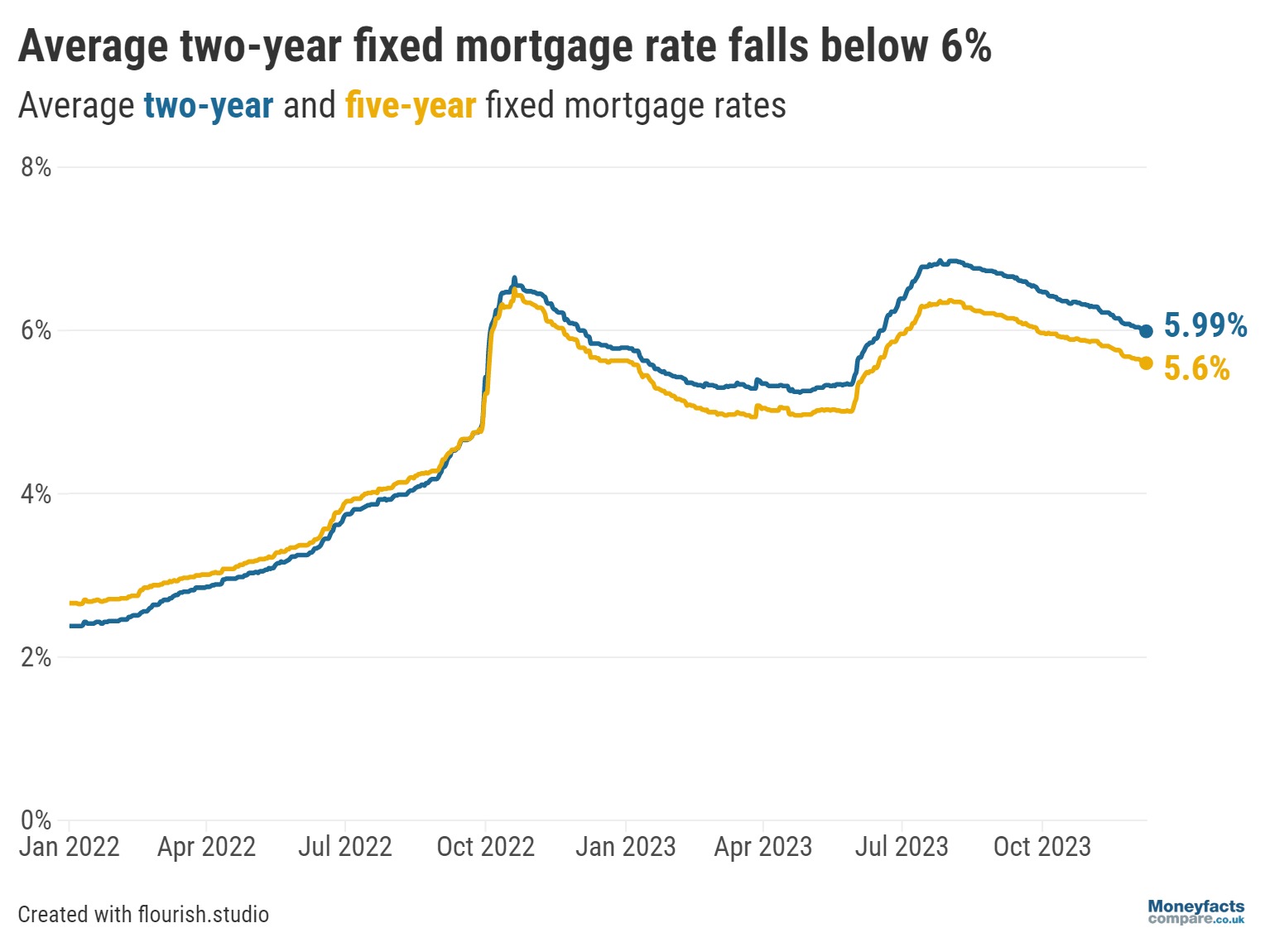

Continuing our previous article, Promising Signs of Recovery | The Mortgage Market 2024, the average 2-year mortgage rate dropped below 6%. This marks a significant decline for the first time in half a year.

Presently, the most competitive rates are at 4.75%. According to an expert, this development can rekindle interest among many prospective buyers.

The notable decrease in mortgage rates will positively impact the housing market. Consequently, potential buyers have an opportune environment. This might stimulate increased activity in the property sector.

The interest rate is 5.99%, down from 6.01% the previous day. This data comes from Moneyfactscompare.co.uk. Lenders are reducing their fixed rates in response to signs of easing inflation. The rate last fell below 6% on June 16, 2023, reaching 5.98%. Conversely, the highest point was on July 26, at 6.68%.

Average 2-year Mortgage Rate Drop | Is there a cause for celebration?

The latest decrease is due to several factors. These include moderating inflation, pauses in the base rate, and reduced swap rates. Swap rates are benchmarks lenders use for fixed-rate mortgage pricing. This downward trend began in early August after peaking at 6.86% in late July.

Interest rates for two-year and five-year fixed mortgages have dipped below 6% again. Therefore, it is an opportune moment for potential homebuyers or those considering refinancing. They should explore favourable financial options now.

Monitoring market trends and consulting financial experts can offer valuable insights. It’s crucial to assess specific financial goals and circumstances. Leveraging current favourable rates can help make informed decisions. These should align with long-term plans.

Source: Moneyfacts

Average 2-year Mortgage Rate Dropped | Is there an improvement in the mortgage market?

Earlier this year, mortgage rates rose due to base rate hikes by the Bank of England’s MPC. They aimed to address persistently high inflation. However, recent developments suggest a positive shift. Inflation has significantly slowed to 4.6% in the year to October. Consequently, the MPC maintained the base rate at 5.25%. As a result, average mortgage rates have gradually declined.

This decline is an encouraging sign that the mortgage market is improving.

Moreover, the mortgage market has seen its most robust product availability in over 15 years. Currently, 5,766 deals are available, reflecting a favourable lending landscape. These trends collectively suggest potential improvement and stability in the mortgage market. This provides a positive outlook for lenders and borrowers.

Average 2-year Mortgage Rate Dropped | How can Connect Mortgages help?

In light of recent 2-year mortgage rate drops, Connect Mortgages offers substantial assistance to prospective homebuyers and those considering remortgaging. Currently, the interest rate hovers around 5.99%. This is a decline from the previous day’s 6.01%. Connect Mortgages can provide various financial options for individuals looking to capitalise on favourable market conditions.

Moreover, interest rates for two-year and five-year fixed mortgages have dipped below the 6% mark. Connect Mortgages is well-placed to help clients navigate these advantageous conditions. Lenders are reducing fixed rates in response to easing inflation. This trend aligns with Connect Mortgages’ commitment to offering competitive and adaptable solutions.

Whether clients want to enter the property market or optimise their existing mortgage arrangements, Connect Mortgages offers a strategic partnership. They help clients make informed decisions tailored to individual financial goals.

Thank you for reading our publication, “Average 2-year Mortgage Rate Dropped | Is this Great News?” Stay “Connect“-ed for more updates soon!