Specialist Mortgages for Every Scenario

One key advantage of using Connect Expert Mortgage Brokers is our direct access to specialist mortgage lenders. These lenders are well-equipped to find the right deal for even the most complex cases. Our extensive client base often requires us to collaborate with specialist lenders to create tailor-made loans. Additionally, we identify and help develop products to meet our clients’ ever-evolving needs and circumstances. Below, we explore some of the diverse markets we cover.

Second Charge Mortgages

Second-charge mortgages are a unique type of loan. They allow homeowners to use the equity in their property as security for a second mortgage while keeping their first mortgage intact. This can be a great option for those needing extra funds without disturbing their existing mortgage. Second-charge lenders have specific criteria, but our brokers can guide you through the process to find the best option for your needs.

Bridging Loans for UK Property

Bridging loans are short-term loans designed to bridge the gap between selling one property and purchasing another. They are useful for those who need quick financing. Our brokers will explain how these loans work and assist you through the application process. Bridging loans can be complex, but with the right advice, they can be a valuable tool for property transactions.

Let to Buy Mortgage

Let-to-buy mortgages are perfect for those looking to rent out their current home and buy a new one. This option can also be ideal for those needing more space or wanting to invest in another property. Our brokers will walk you through the entire process, explaining the benefits and potential pitfalls. With our guidance, you can simultaneously make informed decisions about letting and buying.

Property Development Finance & Advice

Developing property comes with its own set of challenges. Our brokers work with lenders who understand these complexities and can provide the necessary finance. Whether you’re renovating a single property or embarking on a large development project, we offer expert advice to navigate the financial landscape of property development.

Expat Mortgages UK

Expat mortgages are tailored for UK citizens living abroad who wish to purchase property in the UK. These mortgages have different criteria compared to standard UK mortgages. Our brokers can help you understand these differences, calculate how much you can borrow, and find the best mortgage deals available. This service is invaluable for expats wanting to invest in UK property while residing overseas.

Find the Best Interest-Only Mortgage Rates

Interest-only mortgages allow you to pay only the interest on your mortgage for a set period, reducing your monthly payments. These mortgages can be suitable for various scenarios, but it’s essential to understand the criteria lenders consider. Our brokers will help you compare rates, calculate how much you can borrow, and determine if this type of mortgage is right for you.

Equity Release

Equity release allows homeowners to access the equity tied up in their property without selling it. This can be particularly beneficial for those looking to supplement their retirement income in later life. Our brokers can guide you through the options available, ensuring you understand the implications and benefits of equity release.

Later Life Mortgages

Later-life mortgages cater to older homeowners who may find it challenging to obtain a standard mortgage. These mortgages consider your retirement income and other financial circumstances. Our brokers specialise in finding suitable later-life mortgage options, allowing you to enjoy financial security in retirement.

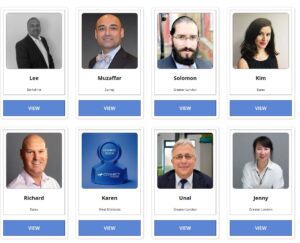

Specialist Mortgage Advice

Our team of mortgage specialists is ready to offer you independent advice, no matter how complex your situation may be. Whether you’re looking for a second-charge mortgage, a bridging loan, or any other specialist mortgage, we can help. Get in touch today to speak with one of our experts or request a callback. We’re here to ensure you find the best mortgage solution for your unique needs.